The Fed Sets The Course In Investment

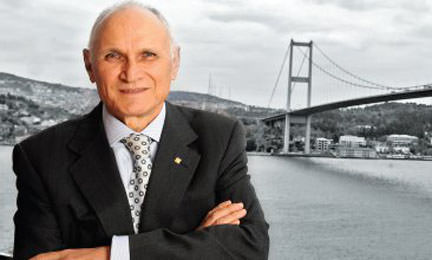

Alarko will keep close tabs all data coming out on the U.S. economy in 2014. CEO Ayhan Yavrucu says, “FED decisions will impact us immensely. Interest, rates of exchange… are factors that can change the direction of investments. We are cautiously optimistic.” Yavrucu argues that keeping exchange and interest rates low is not a good idea, and emphasizes that what`s on the minds of most foreign investors are the “elections.”

Turkish CEOs may be keeping an even closer eye than their American counterparts on the FED in 2014. Alarko Holding CEO Ayhan Yavrucu explains that interest and foreign exchange fluctuations will determine FED policies and that because of this, he will be closely following all U.S. economic data. Yavrucu warns CEOs that in 2014, they “should not take out foreign-currency denominated loans,” since “rates of exchange may rise.” He also stresses that managing accounts receivable risks carefully is critical in this period.

The fog has not yet completely lifted

Alarko Holding CEO Ayhan Yavrucu also agrees with executives who believe that 2013 must be evaluated in two different ways using two different perspectives. Yavrucu states that 2013 seems to have been a good year for Turkey and stresses that it is still difficult to say whether or not the world economy is experiencing a permanent decline in the rate of growth. Yavrucu says “we witnessed the kind of stress developing countries experienced in reaction to the Fed`s announcement that it might resort monetary tightening in 2014.” He also emphasizes the thick dark clouds of 2007-2008 are no longer hovering over, and that the sun could still emerge from behind the clouds. He also says that even so, it`s obvious that the weather is remains foggy and it still might rain. They are approaching negative interest rates in Europe. Yavrucu argues, “Interest is the price of money. Negative interest is an indication of ongoing economic disequilibrium.” He says there is a significant difference in productivity between Germany and the other European countries. He believes that without this gap being closed, the European economy will not achieve a point of equilibrium.

The elections are first and foremost on foreigners` minds

So what parameters will Yavrucu carefully monitor in 2014? Yavrucu responds to this question saying, “Whether you like it or not, there is a single power in the world: the United States. If you make up 25% of the national income generated in the world and your currency is the reserve currency, you shape the world. Therefore, every decision the FED makes will have a significant impact on countries like Turkey. So we have to closely monitor the FED. U.S. data, ranging from growth and employment figures to increases in real estate prices, are data that Turkey must follow upclose. Secondly, there are going to be elections in 2014, and again in 2015. I wish that all the elections were going to be held in 2014 and there wouldn`t be any in 2015… This process keeps raising people`s expectations.”

Yavrucu says that the first question foreign investors raise is about the elections: “They are holding out for the elections to see what happens. I`m not worried about the impact of the elections on the economy. Decisions are not indexed to the elections. But whether you like it or not, foreigners wonder about what is going to happen in the elections. You can say all you want that Turkey has finally achieved political stability and democratic elections are being held, and that Turkey is progressing. But foreigners will always have a question mark in their minds when it comes to emerging markets like Turkey. Nevertheless, Alarko investments will be affected more by external events than domestic ones. They will be impacted by changes in interest and foreign exchange rates. They will also be hit by them in the areas of finding credit and markets.” Bearing this in mind, Alarko is making plans by keeping abreast of the FED`s policies in 2014. Yavrucu states, “Our plans are always made vigilantly. We`re not putting on the brakes, but we are cautious; we are cautiously optimistic.”

Europe won`t let things get out of hand

Ayhan Yavrucu says that he doesn`t expect a major problem in the Middle East. Shale gas exploration, agreement made with Iran … He also states that western countries will not permit serious disorder in the Middle East. He stresses that China has accurately comprehended world developments and has carried out proper reforms. “The authoritarian regime also makes it possible to more easily take the right position. China has reached a turning point. Innovation requires transforming into a country that creates technology rather than one that borrows and applies it. Its most recently made decisions show that it is heading in this direction. However, technological developments overwhelmingly come out of the United States. It is difficult for authoritarian countries to produce creative people, and even when they do, they have a hard time keeping creative brains at home.”

Procurement in energy and looking for opportunities in Iraq

Alarko reached most of its targets in 2013. Yavrucu maintains, “We had a good year. If conditions in the world remain relatively the same as they were 2013, we are set to have an even better year in 2014. But if the parameters take a downturn, new strategies will be necessary.” In other words, will FED decisions give rise to interim budgets this year? Ayhan Yavrucu has this to say: “We`ve been there – 80% inflation, years when exchange rates climbed by 70-80% - So we have enormous experience in this area. 3-5% fluctuations in the world economy will not force us to create interim budgets. We simply have to keep track of what trends there are in expectations and look for developments that might lead us to change lanes. They have an impact on investment decisions but have no influence on day-to-day operations.”

Alarko will be making two major investments in 2014. The lion`s share of its investments lies in the energy sector, which make up nearly 50% of the holding`s investments. The first investment in 2014 will be in the improvement of distribution of electricity. Ayhan Yavrucu announces that investment valued at 150 million TL is planned in MEDAŞ for making the system more effective. MEDAŞ provides electricity distribution and retail sale services in a region encompassing the provinces of Aksaray, Karaman, Kırşehir, Konya, Nevşehir and Niğde. He says: “production of electricity at the Karakuz hydroelectric power plant is planned to commence in May 2014. An investment agreement totaling $100 million for this 76 MW plant is currently being concluded. We are also planning a 1320 MW imported coal-fueled power plant investment with Cengiz Holding in Karabiga. This investment is to reach a figure of $1.5 billion. Moreover, we are in the planning stage for investments in as yet unbuilt hydroelectric and wind power plants, for which we are seeking licenses. We are also working on investment plans to take over existing plants. I think that in 2014 we will add one or more licenses or power plants to our portfolio. Our research will continue.” Alarko also has plans for investing in energy in Iraq. Yavrucu explains that the executives of the energy group are continuing negotiations in the country for an investment in the areas of distribution and production.

Investment in Cyprus with Hillside

Alarko is planning on taking the tourism brand Hillside to Cyprus. Investment concept preparations are continuing. Yavrucu says, “We are going to build a large tourism complex. We will completely manage it ourselves. We do this kind of work well; there is no need for modesty.” The Alarko CEO, pointing out that the company is engaged in the tenders of all large contracting projects, emphasizes that the company is going to participate in new infrastructure projects, too. Yavrucu says, “We submit tenders, without losing sight of reality or getting caught up in the meaningless thrill of competition, and do everything by the book. The bad work you don`t get is the best work.”

In Turkey, interest and the dollar are below what they need to be today

Ayhan Yavrucu believes that the dollar exchange rate has still not reached the level at which it should be: “Economics is a science. Let`s assume fixed productivity. When you adjust the dollar exchange rate for inflation since 2000, you see that it is still not where it should be.” Yavrucu maintains that the root of economic crisis is spending non-existent income and that the recent measures taken by the government, such as the regulations concerning credit cards, are right on the mark. Yavrucu warns that because interest and exchange rates have been below what they should be, people have begun living beyond their means: “People are right to want to live well. But the way to a better life comes from producing more. Living better without greater production is an illusion.” When asked about the Brazilian increase in interest, Yavrucu had this to say: “I think that Turkey needs to raise interest, too”… “You can`t expect to increase savings through negative interest.” He continued: “In economics, interest, as well as exchange rate, is a price. These prices must provide the investor the correct message. Otherwise, it both disrupts resource distribution and increases disequilibrium. If interventions made to correct either create further imbalances, general economic equilibriums will be undermined. Bending under psychological pressure to keep interest rates lower than they should be will only result in greater cost to the Turkish investor, the Turkish economy and to the Turkish people. It may appear in the short term to have favorable repercussions, but in the long term, everything falls into place.”

There`s no limit to investment in solar

Alarko expects to reach 5,000 MW once its investments in energy are complete. Its concentration plan in energy is straightforward. Yavrucu explains that the company places great importance on solar energy and that it has set up a prototype facility in Konya. It also has major solar energy investment plans with Cengiz Holding. Indicating that they are expecting their license from the EPDK (Energy Market Regulatory Authority), he says, “we purchased 2 million 400 thousand square meters property in Konya. The cost of setting up a solar energy facility has gotten cheaper. We will obtain as many licenses and invest much as we can here. The potential is enormous.”

“No one benefits from disputes”

Explaining that Alarko`s real estate partnership with the Dubai company Deyaar is ending, Yavrucu says that the dispute with its partners over their enormous properties in Riva has reached the Court of Appeal. He provides some information about the project they plan to begin in 2014 on this 5 million m2-area: “The main goal is the Riva project.” There is a dispute, too, over Alarko`s General Headquarters in Ortaköy. Yavrucu explains, “We dislike disputes. We`d prefer that two parties get up from the table happy. This is the company`s culture. Ideally, these disputes should not occur. I`ve never seen anyone actually benefit from a dispute. Moreover, our door is always open.”

“Education Reform: a crucial subject:

Ayhan Yavrucu says that there are three areas that will determine the future of Turkey: “There is need for reform in education, taxation and law, which has to be achieved through discussion and consultation at broad-based workshops. We can`t find people to hire. Technical education is in short supply. Every cents in Turkey should be invested in education. Any improvements in education will have spillover effects on everything else in Turkey. The only investment about I boast is the investment I make in my children.”

Alarko Holding Launches “Positive Impact: Green Collar” Program to Invest in Sustainability Competencies

The 2025 Term Begins in Alarko Holding's Pioneers of Entrepreneurship Project!